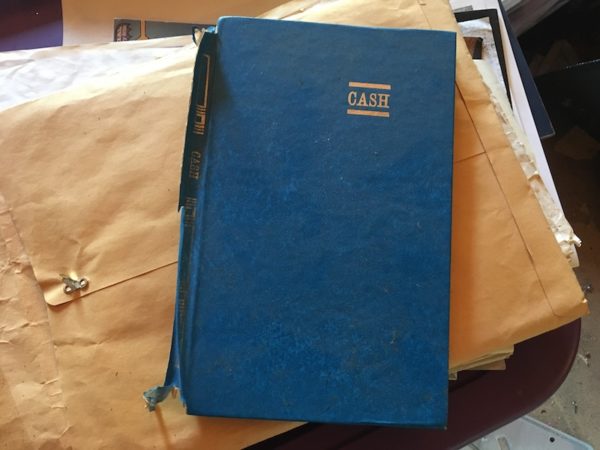

I’ve been clearing out (well, trying to) our barn loft of lots of stuff we never really needed in the first place. A few weeks ago, I came across a ledger I used in my early 30s to keep track of my bills. It had four columns: Owed to, amount owed, due date, and date paid. It was so simple and it worked. I didn’t throw the book away in my cleaning frenzy because it reflected a time when I didn’t really have that many bills or responsibilities and … I just feel like hanging on to it!

Nowadays, most of us tend to pay our bills online and don’t mark it in our little ledgers when we put the check in the mail or put cash in separate envelopes for each bill we owe like our grandparents may have.

Recently, though, I talked to someone who does still keep track of her finances on paper. Stacey Young,  who is Assistant Vice President of Retail Services at University Credit Union in Maine. “I actually keep a little booklet,” she told me. “I know that’s kind of old school, but what happens a lot of times is someone will purchase something and later on in the day they’ll check their balance at the ATM and say, oh great, I have money. They make a withdrawal but the previous purchase hasn’t gone through yet and they end up overdrawn. If they had a register and wrote down their purchases they would know exactly how much money they were dealing with.”

who is Assistant Vice President of Retail Services at University Credit Union in Maine. “I actually keep a little booklet,” she told me. “I know that’s kind of old school, but what happens a lot of times is someone will purchase something and later on in the day they’ll check their balance at the ATM and say, oh great, I have money. They make a withdrawal but the previous purchase hasn’t gone through yet and they end up overdrawn. If they had a register and wrote down their purchases they would know exactly how much money they were dealing with.”

The thing is, most of the people she encounters do everything online. Many younger people have never even written a check and look at her like she’s lost her mind when she suggests keeping a little book of expenses. Whether on paper or online, she says people should find a way to keep track, if for no other reason than to have some peace of mind. The book happens to work for her and she always knows exactly how much money she has.

For young kids

Like many financial institutions, Stacey’s credit union offers programs on handling finances for people of all ages. That includes an interactive online game for young kids called Money Island that teaches the basics of handling money, such as, why, if you get an allowance, saving some of it is a good idea. “It takes them through an adventure,” said Stacey. “They get a passport and have fun and without realizing it they’re learning.”

For not so young kids

At the other end of the age spectrum, there are not only classes on retirement and estate planning, but also on identity theft and scams. “Unfortunately it’s not as trustworthy a world as when they were younger,” said Stacey. “It’s unbelievable now. People can glean little bits of information from different sources — a website or Facebook, what you’re posting on Facebook is a big one. When a scammer calls you, they’ve got a pretty good picture of who you are and will sound like they know a lot about you. We deal with a lot of scams. It’s not because people are ignorant in any way. It’s because times have changed so much and people are trusting.”

For college students

Another group ripe for some lessons on handling their finances are college students. Stacey said they offer a workshop called By the Slice — each topic is a slice of the financial pie. One month may be about budgeting, another how to get a credit card, another how to maintain an account. “Basically, we try to tell students what we wish someone had told us,” she explained. “Too many people make financial mistakes and learn the hard way.”

Why financial fitness is good for your overall health

Allie Andrews owns OmBody Health, which helps businesses and organizations build employee wellness and well-being into their strategic plans and make it part of their overall culture. The issues they tackle go beyond what you might consider health and wellness and include how to be financially fit.

Allie Andrews owns OmBody Health, which helps businesses and organizations build employee wellness and well-being into their strategic plans and make it part of their overall culture. The issues they tackle go beyond what you might consider health and wellness and include how to be financially fit.

“One of the things that we’re hearing a lot about is the impact of stress on our health and wellbeing,” said Allie. “Long-term, the links to cancer, diabetes, obesity, and other chronic conditions and short-term, the ability to focus, problem solve, feel happy, sleep. About 62 percent of Americans report being stressed out about money. So it’s important, through the lens of stress alone, to have a grasp of your financial wellness just like any aspect of health and wellbeing.”

Tips for college students (and really, everybody)

Getting back to college kids, if you can help them have a firmer grasp of how to handle their finances, maybe it will help them live a more stress-free life once they graduate and are on their own. Stacey has some basic tips.

- Know what you have coming in and what you owe. Hopefully, it’s not a huge long list when you’re in college, but it might be when you’re older.

What goes along with that is to not put your head in the sand, which happens a lot. I think the stress that comes with not knowing is what makes you worry. You worry about the unknown.

- Understand your credit score if you have one.

A lot of times kids think they have a good credit score because they have a cell phone and pay for it. They don’t understand that it doesn’t show up as good on your credit score. If you DON’T pay on your phone and it goes to collections, that will show up as a negative on your credit score. They’ll say I just got an apartment or the electric bill is in my name. Well, that’s great but it doesn’t reflect on your credit until you don’t pay. It’s important to check your credit to make sure there’s nothing on there you don’t know about — a medical bill you didn’t pay, a cell phone that you signed on for a friend and they didn’t pay it.

- As mentioned at the beginning of this post, if you use your debit card, check your balance to make sure the amount has cleared before you make another purchase.

I always recommend that people set up alerts on their phone so that every time their balance falls below a certain amount they get an alert. The first overdraft is often a little wake up call. You can get hit with, depending on where you bank, anywhere from $30 up.

- Understand the difference between a need and a want.

So many things we think we need and when you get down to it and try to figure out how to get yourself out of a hole or save for something you want, you can really sharpen that pencil and figure out the difference between a need and a want.

- Save whenever you can.

- Save 5% – 10% of your income

- Try to keep 3 – 6 months worth of living expenses in your savings account

- Put any extra from your budget into your savings

Let go of worrying

“I think a lot of people worry about money,” said Allie. “When I’m worried, I like to take a step back and ask myself what’s wrong right now? Do I have everything I need in this moment to survive? If the answer is yes, then I try to focus on the task at hand, what I’m doing right then. Worry is a big source of stress and a hindrance to our quality of life, but we can be mindful — there can be a mindfulness aspect — even when it comes to money and financial wellness.”

What about you?

Do you have any money handling tips that work well for you?

Leave A Comment